You are here

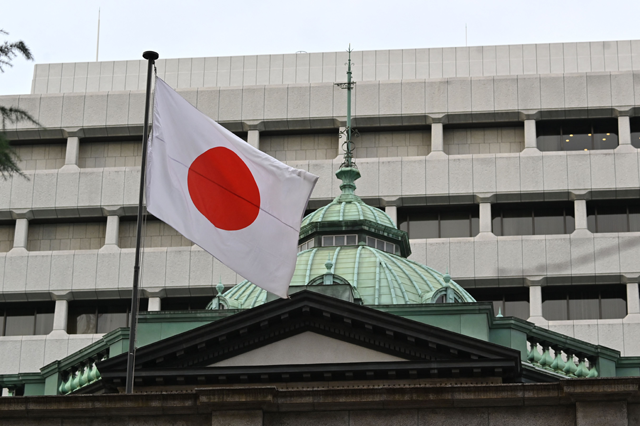

Bank of Japan's next chief says monetary easing 'appropriate'

By AFP - Feb 26,2023 - Last updated at Feb 26,2023

Kazuo Ueda, a candidate for the new governor of the Bank of Japan, speaks during a Q&A session at the House of Representatives of the parliament in Tokyo on Friday (AFP photo)

TOKYO — The Bank of Japan's (BoJ) longstanding monetary easing policies are "appropriate", its next Governor Kazuo Ueda told parliament on Friday, suggesting no sudden changes to the bank's stance when he takes the helm in April.

Ueda, an economics professor, was nominated last week to replace Haruhiko Kuroda, who is stepping down after a decade in the job.

His nomination is expected to be easily approved in parliament, where the ruling coalition commands a healthy majority.

Under Kuroda, the bank unleashed a raft of extraordinary ultra-loose policies — from a negative interest rate to spending vast sums on government bonds — in a bid to boost Japan's sluggish economy.

It has stuck with these measures over the past year, despite pressure to join the US Federal Reserve and other central banks in aggressively hiking interest rates to tackle soaring inflation.

Ueda said Friday he saw the "continuation of monetary easing as appropriate".

"It is necessary to keep monetary easing to support the economy and create an environment where companies can raise wages," he said in his first public address since being nominated by Prime Minister Fumio Kishida.

Government data showed on Friday that Japan's consumer prices rose 4.2 per cent year-on-year in January, a level not seen since September 1981.

The figure, which excludes volatile fresh food, is fuelled in part by higher energy bills and is above the BoJ's longstanding 2 per cent inflation target.

However, because the higher prices are not driven by demand or steady wage increases, the BoJ has said it sees no reason to abandon its easing policies.

Related Articles

TOKYO — The Bank of Japan (BoJ) unexpectedly cut a benchmark interest rate below zero on Friday, stunning investors with another bold move t

TOKYO — Japan's central bank pulled the plug on Tuesday on its ultra-aggressive monetary stimulus programme, hiking rates for the first time

TOKYO — The Bank of Japan (BOJ) on Tuesday maintained its long-standing, ultra-loose monetary policy and offered no guidance on its plans in