You are here

‘Consumers likely to trim consumption following tax hikes’

By Mohammad Ghazal - Jan 16,2018 - Last updated at Jan 16,2018

AMMAN — Jordanian households will need to spend 10-15 per cent extra to maintain the level of their living standards prior to the recent government decision to increase taxes and are expected to resort to rationing consumption, economists said Tuesday.

More spending on foodstuff at the expense of other commodities is also expected with rationing consumption, the economists interviewed by The Jordan Times on Tuesday expected.

“Jordanians will have to spend a minimum of 10 per cent to 15 per cent of their income to maintain the level of living standards they had prior to the increases in taxes and ending bread subsidy,” Maher Mahrouq, an economist, told The Jordan Times on Tuesday.

The government expects to generate more revenues by increasing the sales tax on commodities that are currently subject to 0-4 per cent sales tax to 10 per cent, but this is expected to be coupled with less spending by citizens who have to prioritise, he added.

According to latest available figures by the Department of Statistics in 2013, the average annual spending by a Jordanian household is JD10,250 of which around JD3,500 is allocated for foodstuff.

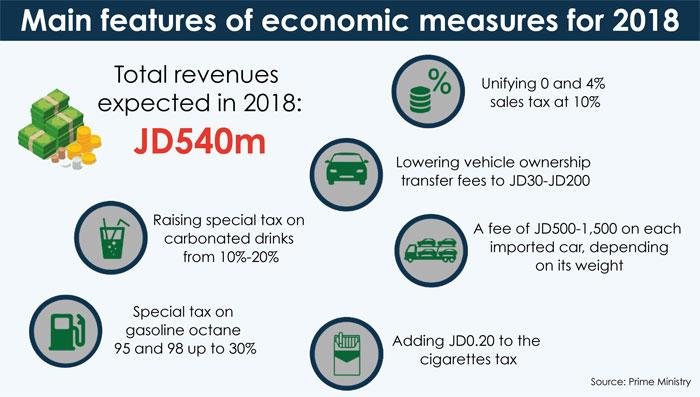

The Cabinet on Monday set JD26.4 as the per capita annual support to offset the impact of lifting the bread subsidy, one of several announced measures to boost revenues. According to an infograph provided by the Cabinet, the total revenues expected from the corrective measures amount to JD540 million plus, which will be generated from lifting the bread subsidy and levying JD500-1,500 on each importing car, depending on its weight, while vehicle ownership transfer fees will be reduced to range from JD30-200. Meanwhile, the government has raised the special tax on carbonated drinks from 10-20 per cent, and on Octane 95 and 98 gasoline to 30 per cent while JD0.20 has been added on cigarette packets, while all sales tax exemptions (zero and 4 per cent) have been modified at a unified rate of 10 per cent.

“Citizens are already rationing their consumption and I expect that they will do that further in the coming period,” Mahrouq said.

It is very difficult for households to maintain their living standards, they will need to spend more to do so, he added.

The government’s recent decisions are expected to directly and indirectly impact other sectors including local industries, he added.

He said these industries are expected to be affected as the costs of production and labour are expected to rise.

“I do not believe that the government will be able to generate what it hopes through increasing the sales tax,” he added, stressing that citizens spending of food, which is a top priority, is expected to increase at the expense of other commodities.

Economist Khaled Zubeidi echoed similar remarks.

“Whenever the sales tax is increased, there is a direct impact on persons’ consumption as that usually declines,” he said.

He agreed that the increase in sales tax is expected to affect several other sectors and that consumers would likely trim their spending, giving priority to food on the table.

“For households that are keen on maintaining their living standard, if they are capable of doing so, they will need to spend additional 10-15 per cent,” he said.

The impact will not only be limited to commodities as prices of other services and goods are expected to increase after the introduction of the new sales tax, he explained.

“Workers for example such as plumbers and others will be charging more and eventually citizens will be affected by this,” he indicated, adding that the government’s measures to mitigate the impact of the price hikes were not enough.

To lessen the impact of ending bread subsidy and amending sales tax, the 2018 draft state budget includes, for the first time, a social safety network/cash subsidy with a value of JD171 million to make up for rising cost of living brought on by lifting subsidies on bread and other commodities, whose sales tax is below 16 per cent with a list of exceptions announced by the Cabinet. The Cabinet, according to Petra, said the net would cover 6.2 million Jordanians, out of 7.8 million citizens, while the rest of around 10 million are non-Jordanians.

The reduced taxes on essential commodities remained unchanged, including sugar, rice, flour, cooking oil, lamb, beef, chicken, fish, fresh milk, children’s milk, eggs, tea, school stationery, pesticides, fertilisers and veterinary medicines, in addition to equipment used by disabled persons for mobility and orthopedic devices.

The government has also increased minimum wage from JD190 to JD220 on Monday.

Citing figures by the department, economist Hosam Ayesh said 40 per cent of Jordanian households spend 50 per cent of their annual spending on foodstuff.

“Households will need no less than 15 per cent in additional spending to maintain the same level of living standard…The situation is tough,” Ayesh said.

“Families of limited and low income will not be capable of spending on luxury commodities or any unnecessary goods or services,” said Ayesh.

Wajdi Makhamreh, another economist, said citizens are expected to resort to boycotting some commodities and reducing the consumption.

“There is a direct and indirect impact not only on Jordanians, but also on several economic sectors and further rationing of consumption is an option but that does not help the economy,” Makhamreh added.

Related Articles

AMMAN — The Cabinet on Monday set JD26.4 as the per capita annual support to offset the impact of lifting the bread subsidy, the Jordan News

AMMAN — Following the announcement of the fourth and final government incentives bundle to stimulate the national economy, economists have p

AMMAN — Although the government’s latest economic measures will “discipline” consumption habits, they could have a negative impact on busine