You are here

PM receives IMF delegation ahead of 6th Extended Fund Facility review

By JT - May 15,2023 - Last updated at May 15,2023

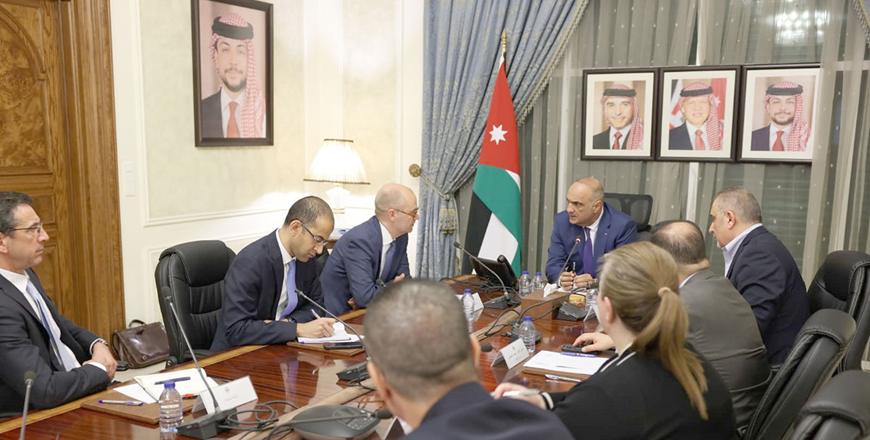

Prime Minister Bisher Khasawneh meets with Head of the International Monetary Fund Mission to Jordan Ron van Rooden and his accompanying delegation on Monday (Petra photo)

AMMAN — Prime Minister Bisher Khasawneh on Monday received Head of the International Monetary Fund (IMF) Mission to Jordan, Ron van Rooden, and his accompanying delegation. The delegation is visiting the Kingdom to conduct the sixth review of the Extended Fund Facility (EFF).

Deputy Prime Minister for Economic Affairs and Minister of State for Public Sector Modernisation Nasser Shraideh, Finance Minister Mohamad Al-Ississ, Minister of Planning and International Cooperation Zeina Toukan and Central Bank Governor Adel Sharkas attended the meeting.

During the meeting, the two sides discussed means to strengthen relations between Jordan and the IMF in service of Jordan’s economic goals, according to a Prime Ministry statement.

The prime minister stressed that the government is making all measures to deal with economic challenges, achieve sustainable development, attract foreign investments and create jobs for Jordanian youth as a means of resolving poverty and unemployment.

Khasawneh also reiterated the government's commitment to promoting macroeconomic stability and enhancing the Kingdom’s competitiveness, noting that the macro-economy has achieved positive indicators in international ratings institutions, the latest of which being the Fitch Credit Ratings Agency’s decision to maintain Jordan’s credit rating with a stable outlook.

For his part, the head of the IMF mission to Jordan reaffirmed his admiration for the reforms implemented by the Kingdom and the government's efforts in dealing with financial and economic challenges.

“Jordan is a success story in maintaining its financial and monetary stability despite the immense challenges of the global economy,” he added.

Van Rooden also referred to Jordan's success in maintaining a low inflation level of only 2.9 per cent, preserving its credit rating and successfully issuing Eurobonds.

Related Articles

AMMAN — Prime Minister Bisher Al Khasawneh on Wednesday met with the International Monetary Fund (IMF) delegation, headed by Ron van Rooden,

AMMAN — Prime Minister Bisher Khasawneh welcomed Head of the International Monetary Fund (IMF) mission to Jordan, Ron van Rooden, and his de

AMMAN — The government and the Central Bank of Jordan, together with the International Monetary Fund (IMF) reached a staff-level agree